blue-host.ru Learn

Learn

Setting Up An Llc In Alaska

Follow the steps below, you can form an Alaska LLC on your own. However, it's much simpler to use an LLC formation service. Complete a quick minute form about the business. Your Alaska LLC formation documents are professionally prepared by our team. We file your LLC formation. Prepare and File the Alaska Articles of Organization. Once you have chosen a name and registered agent for your LLC, you'll need to file the Articles of. ALASKA LLC FORMATION: Form Alaska LLC Online; Alaska business incorporation with MaxFilings Business Incorporation Services. Business services for Alaska. To start a business in Alaska, you begin by forming the LLC or corporation by filing the formation documents with the Alaska Division of Corporations. Name your Alaska LLC · Establish Ownership of your Alaska LLC · Choose a Registered Agent in Alaska · File the Articles of Organization · File the Initial Report. To register, file a Certificate of Registration. You can submit this filing online. As of , the filing fee is $ The LLC must have a registered agent. Before your LLC can legally do business in Alaska, you must complete a form called the Certificate of Registration and submit it to the Division of Corporations. Alaska requires LLCs to file a biennial report. The first report must be filed by January 2 of the year following incorporation and every two years thereafter. Follow the steps below, you can form an Alaska LLC on your own. However, it's much simpler to use an LLC formation service. Complete a quick minute form about the business. Your Alaska LLC formation documents are professionally prepared by our team. We file your LLC formation. Prepare and File the Alaska Articles of Organization. Once you have chosen a name and registered agent for your LLC, you'll need to file the Articles of. ALASKA LLC FORMATION: Form Alaska LLC Online; Alaska business incorporation with MaxFilings Business Incorporation Services. Business services for Alaska. To start a business in Alaska, you begin by forming the LLC or corporation by filing the formation documents with the Alaska Division of Corporations. Name your Alaska LLC · Establish Ownership of your Alaska LLC · Choose a Registered Agent in Alaska · File the Articles of Organization · File the Initial Report. To register, file a Certificate of Registration. You can submit this filing online. As of , the filing fee is $ The LLC must have a registered agent. Before your LLC can legally do business in Alaska, you must complete a form called the Certificate of Registration and submit it to the Division of Corporations. Alaska requires LLCs to file a biennial report. The first report must be filed by January 2 of the year following incorporation and every two years thereafter.

Name Your Alaska LLC · Designate a Registered Agent · File Your Articles of Organization · Create an Operating Agreement · Obtain an EIN and handle taxes · Submit an. Name Your Alaska LLC · Choose a Registered Agent · File Alaska Articles of Organization · Get an Alaska Business License · Submit Initial Report · Set Up Business. This guide takes you through how to start an LLC in Alaska in a few simple steps. And how you can maintain your business and keep it running in the long term. Forming an LLC in Alaska is a process that can be completed online or in paper format with the Department of Commerce, Community, and Economic Development. Total cost, time, and step-by-step instructions to form a limited liability company in Alaska. Do it yourself or purchase our formation service. Once the articles are filed and approved you will then need to properly organize the LLC (this also applies to “1-person LLCs”) by holding an “Organizational. To form an LLC in Alaska, file your Articles of Organization with the Corporation Section. The Alaska LLC filing fee is $ (one-time fee). To start a corporation in Alaska, you must file Articles of Incorporation with Alaska's Division of Corporations. You can file the document online or by mail. At LawInc we are Alaska LLC formation experts who can help you form a Alaska LLC, the right way. We file the Alaska LLC Articles of Organization with the Alaska. 8 Steps to Form an LLC in Alaska · 1. Select a Name for Your New LLC · 2. Appoint a Registered Agent · 3. File Articles of Organization · 4. Draft an LLC. How to start an LLC in Alaska · Choose and reserve a name · Pick a registered agent (RA) · File articles of organization · Prepare an operating agreement · Get. Alaska limited liability companies are formed by filing Articles of Organization with Alaska Department of Commerce, Community and Economic Development. The. The filing fee for the biennial report is a flat fee of $ Taxes. For complete details on state taxes for Alaska LLCs, visit Business Owner's Toolkit or the. Alaska LLC Cost. Alaska's state fee for forming an LLC is $ On top of that, you'll need to pay $ every other year to file a biennial report. The state is. 9 steps to start an LLC in Alaska. 1. Determine your LLC business name. You must choose a “distinguishable” name that differs from other LLC business names in. Forming a limited liability company (LLC) in Alaska has some associated costs. Prior to formation, the LLC must pay a filing fee of $ The Alaska Department. Alaska Limited Liability Company / Alaska LLC formation services: Anchorage, AK , Anchorage County. BBB A+ Rating, EntityWatch® technology. Think of it as a Social Security Number (SSN) for your business, except an EIN is less sensitive. It is important to wait until the LLC has been approved by the. To establish an LLC in Alaska, you must select a business name, designate a registered agent, and submit the Articles of Organization form to the Alaska. Register an LLC in Alaska online with fast, personalized support from Rocket Lawyer. Answer a few simple questions and we'll do the paperwork for you!

What Is A Will And Testament

Start your legal document by using the title “Last Will and Testament” and including personally identifiable information, such as your full name and address. A living will, most commonly referred to as a Healthcare Directive, is used to make decisions about medical treatments in the event of serious illness or injury. Since your Last Will and Testament takes effect at your death, it does not deal with health care instructions. What you need to know about creating a Last Will and Testament. Wills. What is a Will? A will is a legal document that gov- erns the disposition of your. A Last Will and Testament is a legal document that communicates a person's final wishes pertaining to assets and dependents. How is a will processed after I die? A will must be processed through the court system before the assets are distributed to the beneficiaries. This process is. Your last will and testament (often simply referred to as your will) is a legal document that outlines your wishes for your estate and dependants after you pass. A last will and testament allows you to decide how you want your property to be distributed among family, friends or charities. LegalZoom can help you start. Overview. A will is a legal document that allows you to: direct how your property will be distributed after your death; name your personal representative. Start your legal document by using the title “Last Will and Testament” and including personally identifiable information, such as your full name and address. A living will, most commonly referred to as a Healthcare Directive, is used to make decisions about medical treatments in the event of serious illness or injury. Since your Last Will and Testament takes effect at your death, it does not deal with health care instructions. What you need to know about creating a Last Will and Testament. Wills. What is a Will? A will is a legal document that gov- erns the disposition of your. A Last Will and Testament is a legal document that communicates a person's final wishes pertaining to assets and dependents. How is a will processed after I die? A will must be processed through the court system before the assets are distributed to the beneficiaries. This process is. Your last will and testament (often simply referred to as your will) is a legal document that outlines your wishes for your estate and dependants after you pass. A last will and testament allows you to decide how you want your property to be distributed among family, friends or charities. LegalZoom can help you start. Overview. A will is a legal document that allows you to: direct how your property will be distributed after your death; name your personal representative.

A Last Will and Testament is a legal document that outlines your last wishes. Make yours for free and save, print & download. A Last Will and Testament is your personal instruction manual about what is to happen to you, your remains and your possessions after you die. Last Will and Testament (Will). A last will and testament or will is a legal document outlining how an individual (testator) wants to transfer their assets. A Will addresses three primary issues after your death. Your Will controls only assets titled in your sole name or in tenancy in common (your “probate estate”). A Will, also known as a Last Will and Testament, is a legally prepared and bound document that states your intentions for the distribution of your assets and. A last will is a legal document stating your final wishes and instructions regarding passing on your assets and property to designated beneficiaries. A Will is a written document which directs how property which is titled in your name at the time of your death is distributed to beneficiaries. A will is a written document directing the disposition of a person's assets after death. Requirements For A Valid Will. In Maryland, a will must be signed by. What you need to know about creating a Last Will and Testament. Wills. What is a Will? A will is a legal document that gov- erns the disposition of your. Last Will & Testament. This Last Will and Testament is a legal document that communicates a person's final wishes pertaining to possessions and dependents. It. A will is a legal document that sets forth your wishes regarding the distribution of your property and the care of any minor children after your death. A Will is a written document outlining your choices about who will receive your property you own only in your name and how it will be divided when you die. A will, also called a last will and testament, is a legally enforceable declaration of how a person wants his or her property and assets distributed after. More commonly referred to as a “will,” a last will and testament is a legal document that allows a person (called a testator) to: designate who will receive. Your last will and testament is a legal written document that specifies where and to whom you wish your property and possessions – known as your 'estate' – to. A will provides for the distribution of certain property owned by you at the time of your death, and generally you may dispose of such property in any manner. A living will, most commonly referred to as a Healthcare Directive, is used to make decisions about medical treatments in the event of serious illness or injury. People encounter several legal documents when doing estate planning, including a last will and testament. This official paper states what will happen to a. A last will and testament is a legal document that outlines a person's instructions on their specific property and communicates their final wishes to. A last will and testament is a legal document that specifies how you want your assets to be distributed after your death. It also allows you to name an executor.

Buying A Car Online Without Seeing It

The main difference between traditional and online car buying is that most of the transaction is completed without going to the dealership when buying a vehicle. Have a trusted mechanic check out a used car before you buy it. · Check an online service, such as blue-host.ru, to find accident and repair records, including. No. A lot can be wrong with a car, so you want to be able to see it before you buy it. You also want to make sure that the car is in good. Private owners sell their own used vehicles without any dealer mark-up. If you buy from a private owner, get copies of the vehicle's service records, references. Buy a new car online and have it delivered by Herb Chambers Companies. If you're searching for the best online car buying sites in MA or RI, buy local with. Contact your state's DMV or look on the DMV website to see what required inspections your car will need. Depending on state laws, this may include odometer. Do lots of research beforehand · Check the vehicle's history online · Are you buying from a reputable dealer? · Ask for photos and ideally a video from the seller. Depending on where you buy your car, you may be able to pick it up at the dealership or have it delivered to your home or office. Inspect your vehicle once more. Even if your state DMV doesn't require it, request a bill of sale signed by all parties that spells out the agreed price, the car's year, make, model, VIN. The main difference between traditional and online car buying is that most of the transaction is completed without going to the dealership when buying a vehicle. Have a trusted mechanic check out a used car before you buy it. · Check an online service, such as blue-host.ru, to find accident and repair records, including. No. A lot can be wrong with a car, so you want to be able to see it before you buy it. You also want to make sure that the car is in good. Private owners sell their own used vehicles without any dealer mark-up. If you buy from a private owner, get copies of the vehicle's service records, references. Buy a new car online and have it delivered by Herb Chambers Companies. If you're searching for the best online car buying sites in MA or RI, buy local with. Contact your state's DMV or look on the DMV website to see what required inspections your car will need. Depending on state laws, this may include odometer. Do lots of research beforehand · Check the vehicle's history online · Are you buying from a reputable dealer? · Ask for photos and ideally a video from the seller. Depending on where you buy your car, you may be able to pick it up at the dealership or have it delivered to your home or office. Inspect your vehicle once more. Even if your state DMV doesn't require it, request a bill of sale signed by all parties that spells out the agreed price, the car's year, make, model, VIN.

No test-drive. If you complete the entire purchase without setting foot on the car lot, you pass up a valuable chance to test-drive the vehicle. A test-. Buy Your Car Online, Have It Delivered · Find the Right Car for You · Get Pre-Qualified Without Impacting Your Credit Score · Get Your Trade Appraisal Online. Do your research online first before visiting the dealer. Bring a copy of the ad or offer you seen online. [Back to top]. Leasing v Buying. Downloads. Use this. Get Pre-Qualified Without Impacting Your Credit Score. By pre-qualifying for an auto loan, you can see personalized financing terms for your selected vehicle. How to Buy a Car Without Seeing It · Step 1: Read the Advert Carefully · Step 2: Examine the Pictures · Step 3: Phone the Seller · Step 4: Carry Out a History Check. Find a car you love and do the paperwork online with help from us. Then have it delivered to you or schedule an express pickup at your nearest CarMax store. As with any vehicle purchase, you should ensure the seller is legitimate. Using an established online car dealer, whether it's Carvana or a reputable local. You should ask these questions on the phone to help decide whether you want to go and see the car. vehicles without the “brand.” Ask to examine the. Here are our reasons for playing it safe by buying a car online from a local car dealership company: Ensure a fair trade-in by going through an Arizona company. If you are going to be buying a car online without seeing it, then you need to use a trusted car sales escrow service to hold the money until you have had the. As with any vehicle purchase, you should ensure the seller is legitimate. Using an established online car dealer, whether it's Carvana or a reputable local. If you buy a car without seeing it in person - online, for instance - then you have a day cooling-off period during which time you can return it to the. buyers whether a used car is being sold with or without a warranty. Dealers If you don't see the buyer's guide in the car window, ask to see it before you. Before you start shopping for a used car from an auto dealer in person or online, do some homework. It may save you serious money. Fortunately, nearly every step in the car-buying process can be completed online with much less stress. In most cases, though, a final trip to a dealership is. Critics of online car shopping may argue that you miss out on a better offer since online car buying usually does not involve salespeople. Going into a. There's no getting around it, buying a car online can be risky. However, we've made it safe to do so at Swap Motors. We verify all our sellers and cars, so you. Learn about the online car buying process at Carvana. Shop over vehicles & have the perfect ride delivered to your door with a 7-day test drive. How to Buy a Car Online and Have it Delivered · Step 1: Choose a Vehicle · Step 2: Click "Buy Online" · Step 3: Vehicle Coverage and Protection · Step 4: Do You.

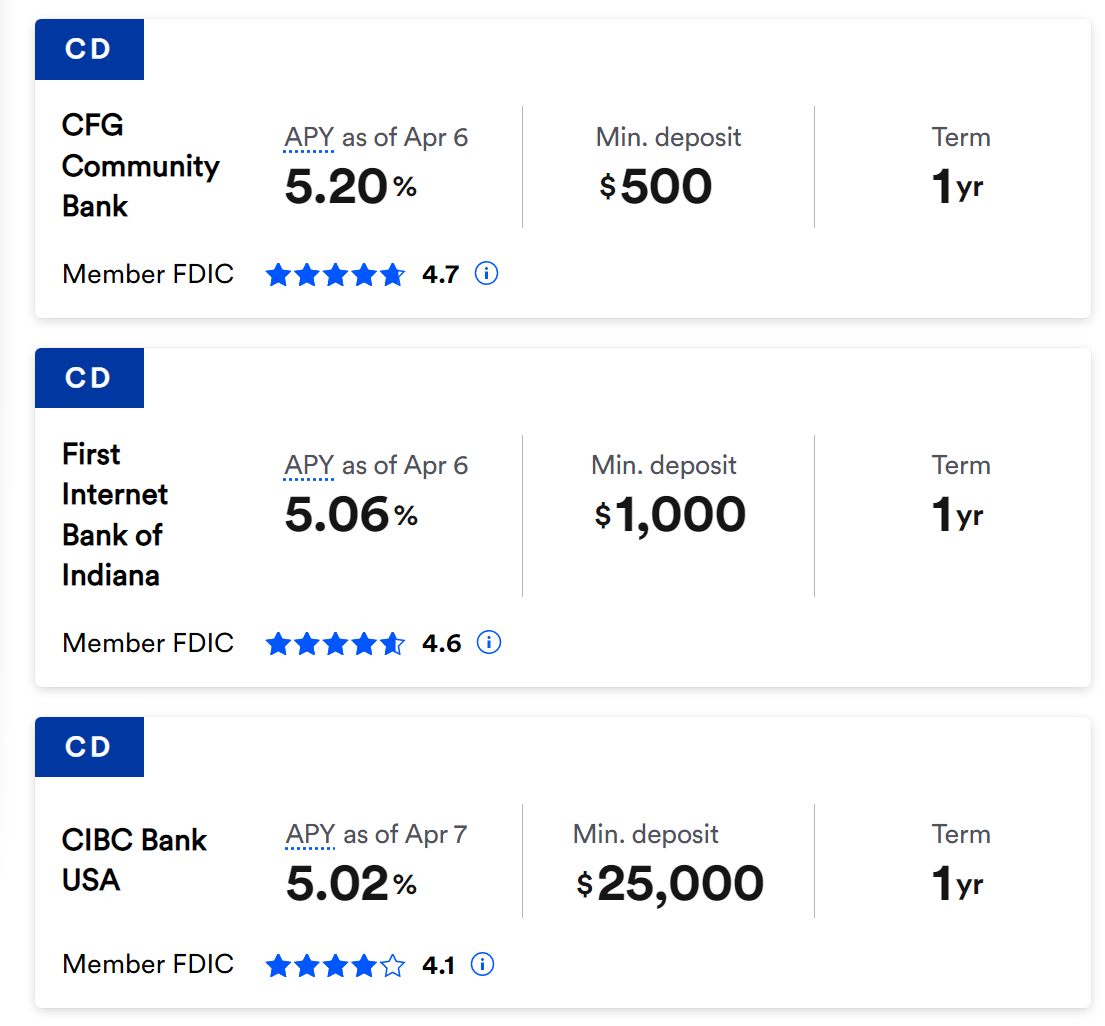

What Cd Has The Highest Interest Rate

Right now, the best 1-year CD rate is % APY from Mountain America Credit Union and Merchants Bank of Indiana. Compare the highest 1-year CD rates. CDs: A Great Way to Save · Certificates of Deposit (CDs) keep your money safe long term with higher interest than most Money Market and Savings accounts. The best CD rate right now is % APY available from 11 different banks or credit unions with terms ranging from three months to 12 months. As of September 9, , the bank or credit union with the highest CD rate is % with Financial Partners Credit Union. The minimum account opening deposit is. Score big when you earn % APY* with a high-yield savings account. · Win with a higher fixed interest rate on a CD at % APY** for 7 months. · It's a double. Compare Popular Direct CD rates and terms. Certificate of Deposit accounts guarantee you a fixed interest rate when you commit to a fixed deposit period. The best rate we've found is % APY from California Coast Credit Union Celebration Certificate. However, the credit union has a small footprint for eligible. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. The highest 6-month CD rate today is % from Merchants Bank of Indiana. Best 9-month CD rates. The highest 9-month CD rate today is % from CIBC USA. Right now, the best 1-year CD rate is % APY from Mountain America Credit Union and Merchants Bank of Indiana. Compare the highest 1-year CD rates. CDs: A Great Way to Save · Certificates of Deposit (CDs) keep your money safe long term with higher interest than most Money Market and Savings accounts. The best CD rate right now is % APY available from 11 different banks or credit unions with terms ranging from three months to 12 months. As of September 9, , the bank or credit union with the highest CD rate is % with Financial Partners Credit Union. The minimum account opening deposit is. Score big when you earn % APY* with a high-yield savings account. · Win with a higher fixed interest rate on a CD at % APY** for 7 months. · It's a double. Compare Popular Direct CD rates and terms. Certificate of Deposit accounts guarantee you a fixed interest rate when you commit to a fixed deposit period. The best rate we've found is % APY from California Coast Credit Union Celebration Certificate. However, the credit union has a small footprint for eligible. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. The highest 6-month CD rate today is % from Merchants Bank of Indiana. Best 9-month CD rates. The highest 9-month CD rate today is % from CIBC USA.

When you get a high-yield CD from BrioDirect, your interest compounds daily and will be added at maturity. Its 1-month CD rate is %, and it has one of the. Compounding interest: Interest Rate vs. APY Like savings accounts, CDs earn compound interest—meaning that periodically, the interest you earn is added to. HIGH-GROWTH CERTIFICATES OF DEPOSIT · You always want to let your CD mature. If you withdraw your funds before any CD's maturity date, your interest rate is no. Top CD Interest Rates · Marcus by Goldman Sachs · Sallie Mae Bank 14 Month CD · Live Oak Bank 1-Year Personal CD · Western Alliance Bank High Yield CD · Discover. The best CD rate is % on a six-month CommunityWide Federal Credit Union CW Certificate Account, though you can find competitive yields on other terms too. CDs typically differ from savings accounts because the CD has a specific, fixed term before money can be withdrawn without penalty and generally higher interest. A CD is a secure way to grow your savings with a higher interest rate than a regular savings account. At TowneBank, a personal banker can assist you in choosing. Score big when you earn % APY* with a high-yield savings account. · Win with a higher fixed interest rate on a CD at % APY** for 7 months. · It's a double. Broadway Bank offers competitive Certificate of Deposit rates, including a 3-month % APY Jumbo CD. Explore our CD options. The average 5-year online CD yield had three straight months of decline, and it's the largest three-month decline since From December 1, to March 1. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. Today's CD Special Rates ; 4 month · % · % · % · % ; 7 month · % · % · % · % ; 11 month · % · % · % · %. The highest locked-in rate we've found is through CommunityWide Federal Credit Union, which pays % APY on a 6-month term. A deposit of at least $1, is. It depends entirely on the lender as to the spread in interest rates between cd and savings/money market rates. At my bank there is less than. As of September 9, , the bank or credit union with the highest CD rate is % with Financial Partners Credit Union. The minimum account opening deposit is. A certificate of deposit (CD) is an account that offers you a higher interest rate than a traditional savings account in exchange for leaving your money. With a CD, you're only allowed an initial one-time deposit. If you're interested in making monthly or recurring deposits, a High Yield Savings Account. Explore our wide range of CD account terms that can help you earn more interest. Open an account. Find the right CD account rates. A Certificate of Deposit (CD) account is a low risk, high-rate savings account option. With a fixed interest rate that is often higher than a traditional. In exchange, your bank promises to pay you a fixed APY for the entire year. Most CDs have a minimum deposit amount, and some banks offer higher interest rates.

How To Calculate Sq Ft Of A Room

Do the math the same way, then divide by to get your total in square feet. When calculating square footage account for the entire space (i.e. under vanity/. -For square or rectangular areas, multiply the length by the width and then divide the result by to get your total in square feet. To calculate the square footage of a space based on square inches, divide the square inches value by Square Inches of a Room / = Square Footage of the. If the ceiling is angled, it must be 7 feet or higher for at least half of the room's floor area. If it is, then any part of the room with a ceiling of 5 feet . Measure the length and the height of each wall, and multiply the height times the width. This gives you the square footage. For example, a 8 feet high wall that. The area of a square room is the length of one side multiplied by itself. To be sure the room is an exact square, measure two adjoining sides. How to measure. In a square or rectangle area, the square footage is determined by simply multiplying the length by the width in feet. A single unit in square footage is 1. Take length and width measurements for each segment of the room separately and then calculate the square footage for each one. Add those square footages. Square Footage Calculator The Square Footage Calculator estimates the square footage of a lot, house, or other surfaces in several common shapes. If the. Do the math the same way, then divide by to get your total in square feet. When calculating square footage account for the entire space (i.e. under vanity/. -For square or rectangular areas, multiply the length by the width and then divide the result by to get your total in square feet. To calculate the square footage of a space based on square inches, divide the square inches value by Square Inches of a Room / = Square Footage of the. If the ceiling is angled, it must be 7 feet or higher for at least half of the room's floor area. If it is, then any part of the room with a ceiling of 5 feet . Measure the length and the height of each wall, and multiply the height times the width. This gives you the square footage. For example, a 8 feet high wall that. The area of a square room is the length of one side multiplied by itself. To be sure the room is an exact square, measure two adjoining sides. How to measure. In a square or rectangle area, the square footage is determined by simply multiplying the length by the width in feet. A single unit in square footage is 1. Take length and width measurements for each segment of the room separately and then calculate the square footage for each one. Add those square footages. Square Footage Calculator The Square Footage Calculator estimates the square footage of a lot, house, or other surfaces in several common shapes. If the.

For Rolled Goods, like Carpet and Sheet Vinyl, measure from edge to edge of the room, including closets and other nooks in the space. Measuring to account for. Therefore, if you can measure the width and length of the room, you can easily calculate the square footage by simply multiplying the two measurements. The. To calculate the square footage of a room, multiply the length by the width. For example, if a room is 10 feet long and 12 feet wide, the square footage of the. The same method is used when measuring walls. Measure the area to be tiled on each wall. Add them together and figure the square footage. Add your waste factor. To find the area in square feet, simply measure the length and width of the rectangular room in feet and then multiply these two dimensions. When your project consists of multiple areas or rooms, we recommend drawing the spaces and dividing them into separate areas. Measure each area separately, and. You just multiply the length of a room or house in feet by the width in feet. Unfortunately, that equation only applies to rooms and homes that are. With your tape measure, pencil, and paper in hand, start by measuring the rooms where you currently live as a point of comparison. The square footage. Square Foot Calculator To calculate the square feet of a room, you'll need two measurements; the length and width of your room. Once you have these. Length C feet inches. Width A feet inches Width B feet inches Width C feet inches. Calculate Clear. Total Area 0 ft2. Allowing 5% wastage 0 ft2. Allowing 10%. Then, multiply the two figures together: Sq ft = Length (ft) × Width (ft). To calculate the square feet of an 'L' shaped room or area, divide the shape. All you need to do is multiply the length of the room by the width of the room. From example, if a room is 10 feet wide and 15 feet long, you would multiply To calculate square feet using feet, simply multiply the length of the area by its width in feet. For instance, if a room is 10 feet long and 15 feet wide. Assuming the room is rectangular and the lengths are in metres, multiply the length by then multiply the width by Multiply. To get a rough estimate of the amount of square footage of flooring that you will need for that room, multiply the length of the room by the width of the room. For instance, if the room is rectangular, measure the length and width in feet. Then, multiply them together to find the area in square feet. For oddly shaped. If your room is made up of various spaces, break your room up into different rectangles. Calculate the square feet for each rectangle separately then add up the. Multiply the rectangle's length by its width to get the area in square feet. Write this number down in the corresponding space on your sketch. Add up the total. To find the square footage of the area, divide the irregular shape into multiple squares or rectangles, labeled A, B, C, and D. Find the Area of A, B, C and D. To find the square footage -- or the area -- of the space, just multiply the length times the width, just as you would do with any rectangle. Ex: 12 feet ( m).

Stock Market Shares Definition

Market Share is, very simply, the percentage of a certain sector that your product, service or software is responsible for, calculated by sales. Stock exchange, organized market for the sale and purchase of securities such as shares, stocks, and bonds. In most countries the stock exchange serves as a. Definition: Out of total purchases of a customer of a product or service, what percentage goes to a company defines its market share. Equity can be defined as the amount of money the owner of an asset would be paid after selling it and any debts associated with the asset were paid off. For. Capital markets are financial markets that bring buyers and sellers together to trade stocks, bonds, currencies, and other financial assets. Capital markets. A share market may also be referred to as a stock exchange. There are multiple share markets across the globe with some better known ones being the New York. A share is the unit of stock; the more shares you buy, the more stock you have in a company. Stocks are issued by companies to raise money to grow their. Put simply, the stock market is the collection of all of the places the general public can buy and sell stocks. This includes stock exchanges, like the New York. A share of stock is a unit of ownership in the business. The number of shares determines how big of a piece of ownership in a business you have. Market Share is, very simply, the percentage of a certain sector that your product, service or software is responsible for, calculated by sales. Stock exchange, organized market for the sale and purchase of securities such as shares, stocks, and bonds. In most countries the stock exchange serves as a. Definition: Out of total purchases of a customer of a product or service, what percentage goes to a company defines its market share. Equity can be defined as the amount of money the owner of an asset would be paid after selling it and any debts associated with the asset were paid off. For. Capital markets are financial markets that bring buyers and sellers together to trade stocks, bonds, currencies, and other financial assets. Capital markets. A share market may also be referred to as a stock exchange. There are multiple share markets across the globe with some better known ones being the New York. A share is the unit of stock; the more shares you buy, the more stock you have in a company. Stocks are issued by companies to raise money to grow their. Put simply, the stock market is the collection of all of the places the general public can buy and sell stocks. This includes stock exchanges, like the New York. A share of stock is a unit of ownership in the business. The number of shares determines how big of a piece of ownership in a business you have.

Stocks, shares and equities are terms used to describe units of ownership in one or more companies. The owner – known as a shareholder – will receive. The percentage of a market held by a firm is known as market share. The more control the corporation has over its rivals, the greater its market share is. Value investing - A strategy whereby investors purchase equity securities that they believe are selling below estimated true value. The investor can profit by. Companies issue shares as a means of raising money Putting your money into shares can seem daunting if you're a newcomer to stock market investing. Market share is the percentage of the total revenue or sales in a market that a company's business makes up. For example, if there are 50, units sold per. These shares are typically traded on a stock exchange. Why should I consider equities? Equity investors purchase shares of a company with the expectation that. The percentage of an industry or market's total sales that is earned by a particular company over a specified time period. Market share is calculated by. Market share is the percentage of a certain market that an individual company's sales are responsible for. Market share is used to give you an idea of how. Shares (noun). Plural of share, referring to multiple units of stock. Example: “The company issued new shares to raise capital.”. A stock market, equity market, or share market is where people buy and sell stocks. The share market serves as a platform for investors to participate in the. Definition: The capital of a company is divided into shares. Each share forms a unit of ownership of a company and is offered for sale so as to raise. Stocks are a type of security that gives stockholders a share of ownership in a company. Stocks also are called “equities.” U.S. Securities and Exchange. The stock market refers to public markets that exist for issuing, buying and selling stocks that trade on a stock exchange or over-the-counter. For example, if X invests in stocks, it means that X has a portfolio of shares across different companies. What is a share in the stock market? A share. Market share refers to the portion or percentage of a market earned by a company or an organization. In other words, a company's market share. After the IPO, stockholders can resell shares on the stock market. Stock Value stock shave a low price-to-earnings (PE) ratio, meaning they are cheaper to buy. A share price – or a stock price – is the amount it would cost to buy one share in a company. The price of a share is not fixed, but fluctuates according to. A stock exchange is a marketplace where securities, such as stocks and bonds, are bought and sold. Bonds are typically traded Over-the-Counter (OTC), but some. Definition · Common stock. A stock represents a share in the ownership of a company, including a claim on the company's earnings and assets. · Preferred stock. Thus, the share market meaning is a place where buyers and sellers come together only for trading stocks. Why Get Listed Since you know what is stock exchange.

What Is Sage Program Used For

What is Sage 50 Accounts software used for? Sage 50 Accounts software helps you to manage your business accounting and finances. It helps you to manage. It helps construction companies manage their financial transactions, track expenses, handle payroll, create invoices, manage budgets, and generate financial. Sage Accounting is software for managing for day to day accounting transactions for your business so you can keep on top of your taxes. Innovate ERP software solutions from Sage Sage Business Cloud offers more than traditional ERP solutions. Our suite of enterprise resource planning tools is. Sage software can be used for everything from the simplest jobs to managing complex financial systems. Sage Business Cloud Accounting | Sage US. Accountants and CPAs can grow their accounting firms & develop better client relationships with Sage accountant software. Transform your practice today. Sage Accounting is software for managing your business's accounting, and staying on top of your taxes. It allows you to quickly and easily create and track. Students Achieve Goals through Education (SAGE) program is one component of Towson University's cultural diversity and student retention plan. Sage software can be used for everything from the simplest jobs to managing complex financial systems. Some of the main features of Sage are as follows. What is Sage 50 Accounts software used for? Sage 50 Accounts software helps you to manage your business accounting and finances. It helps you to manage. It helps construction companies manage their financial transactions, track expenses, handle payroll, create invoices, manage budgets, and generate financial. Sage Accounting is software for managing for day to day accounting transactions for your business so you can keep on top of your taxes. Innovate ERP software solutions from Sage Sage Business Cloud offers more than traditional ERP solutions. Our suite of enterprise resource planning tools is. Sage software can be used for everything from the simplest jobs to managing complex financial systems. Sage Business Cloud Accounting | Sage US. Accountants and CPAs can grow their accounting firms & develop better client relationships with Sage accountant software. Transform your practice today. Sage Accounting is software for managing your business's accounting, and staying on top of your taxes. It allows you to quickly and easily create and track. Students Achieve Goals through Education (SAGE) program is one component of Towson University's cultural diversity and student retention plan. Sage software can be used for everything from the simplest jobs to managing complex financial systems. Some of the main features of Sage are as follows.

Explore Sage accounting & Sage Intacct software to increase efficiency, drive growth, & move beyond using spreadsheets for accounting. Get a demo. Engineers and designers use Sage software to model and optimize stirling cycle engines and coolers, pulse-tube cryocoolers, and other types of cryocoolers. Sage University offers a comprehensive portfolio of training solutions for a variety of roles and skills to meet the education requirements of each organization. The Semi-Automatic Ground Environment (SAGE) was a system of large computers and associated networking equipment that coordinated data from many radar sites. It allows you to quickly and easily create and track invoices cash flow, accept payments, record transactions, automate admin, capture expenses, and more. The. "Sage Software" redirects here. For other uses, see Sage § Software. Not to be confused with Scientific Advisory Group for Emergencies or Sage Publishing. The. Sage People's powerful and user-friendly software will give you actionable insights, automate repetitive tasks, and create great workforce experiences for your. Sage Intacct is a powerful cloud accounting software designed to streamline financial management for growing organizations (typically 20+ employees) and mid-. Sage 50 (UK) is the best (for some) accounting software. It's the only one that allows easy exporting/archiving of your data and restore to. Sage 50 is Sage 50cloud Accounting software, a desktop software product with a cloud connection for small businesses that includes payroll. Sage ERP is business management software used for accounting and other business processes. ERP is enterprise resource planning. Sage 50 integrates with a wide range of third-party software to streamline your operations and improve efficiency, including Microsoft , Worldline for direct. Why Sage Accounting Is the Best Accounting Software for Financial Reporting Sage 50's cloud-based accounting software generates complex reports in mere. Innovate ERP software solutions from Sage Sage Business Cloud offers more than traditional ERP solutions. Our suite of enterprise resource planning tools is. "Sage Software" redirects here. For other uses, see Sage § Software. Not to be confused with Scientific Advisory Group for Emergencies or Sage Publishing. The. This model allows them to offer updates for free and keep the software in line with current rules/regulations which tend to change approx. every. Sage is one of the few accounting software providers that still offers a desktop-based program. Its hybrid solution, Sage 50 Accounting, runs on a desktop but. It offers accounting, distribution, manufacturing, project management, and CRM. Sage software also provides multiple language and currency support, making. Why Sage Accounting Is the Best Accounting Software for Financial Reporting Sage 50's cloud-based accounting software generates complex reports in mere.

Reverse Mortgage Predatory

As financial pressures on seniors have increased, the numbers of reverse mortgages have grown, and so have the opportunities for unscrupulous lenders to take. Please verify what documents need each certificate with Illinois Anti-Predatory Lending (ILAPLD). Reverse Mortgage; Revolving Credit Mortgage; Second Mortgage. Where the borrower can prove by clear and convincing evidence that the reverse mortgage lender is liable for financial abuse, he or she is entitled to recover. Predatory lending is the practice of preying on, or taking advantage of, an individual or group of people that may have a difficult time buying or refinancing a. Reverse Mortgages (Audio). Reverse mortgages are quite a bit different from other types of debt. A reverse mortgage is a loan against your home that you do. Unfortunately, as the popularity of reverse mortgages grows, so does the potential for fraud. Predatory lenders, unscrupulous loan agents, and dishonest. Reverse mortgages are awful and predatory. Are they not on medicare/medicaid? The last thing they need to do is touch the house. Long as they. Reverse Mortgages are Predatory Lending. 38 likes. The purpose of this page is to educate people about the perils of Reverse Mortgages and connect with. First, do some research on reverse mortgages AND lenders/loan officers. They are very fee intensive, simply by product requirements. As financial pressures on seniors have increased, the numbers of reverse mortgages have grown, and so have the opportunities for unscrupulous lenders to take. Please verify what documents need each certificate with Illinois Anti-Predatory Lending (ILAPLD). Reverse Mortgage; Revolving Credit Mortgage; Second Mortgage. Where the borrower can prove by clear and convincing evidence that the reverse mortgage lender is liable for financial abuse, he or she is entitled to recover. Predatory lending is the practice of preying on, or taking advantage of, an individual or group of people that may have a difficult time buying or refinancing a. Reverse Mortgages (Audio). Reverse mortgages are quite a bit different from other types of debt. A reverse mortgage is a loan against your home that you do. Unfortunately, as the popularity of reverse mortgages grows, so does the potential for fraud. Predatory lenders, unscrupulous loan agents, and dishonest. Reverse mortgages are awful and predatory. Are they not on medicare/medicaid? The last thing they need to do is touch the house. Long as they. Reverse Mortgages are Predatory Lending. 38 likes. The purpose of this page is to educate people about the perils of Reverse Mortgages and connect with. First, do some research on reverse mortgages AND lenders/loan officers. They are very fee intensive, simply by product requirements.

In March of , the. Illinois Predatory Loan Prevention Act (PLPA) went into effect. • Reverse Mortgages. • Using Your Home as Collateral. • High-Cost and. Scams can involve phony appraisals of home values, inaccurate loan documents, false mortgages, high fees, useless "info sessions," and outright theft. As the. Instead of the homeowner borrowing money for a mortgage and making monthly payments over a period of time (like 30 years), the reverse mortgage loan is not due. Predatory lenders are any lender that takes advantage of homeowners for financial gain by imposing unfair and abusive loan terms on borrowers. Reverse mortgages are a way for older homeowners to borrow money based on the equity in your home. Here's what to know about the potential risks. "It's more of a problem in the groups that aren't regulated as much, such as mortgage lenders and mortgage brokers. Sometimes predatory lending happens there. According to Plaintiff's Complaint, a reverse mortgage is a type of home equity loan available only to senior homeowners whereby the homeowner is able to. If you get a reverse mortgage, you can't lose your house to foreclosure the way you could with a home equity loan. A reverse mortgage does use the equity in. What is Predatory Home Lending? · agree to buy something on the spot because the lender says it might not be available later, · agree to a home equity loan if you. Consumer Advocates Against Reverse Mortgage Abuse. CAARMA is a new (c)(3) with a straightforward plan to TRANSFORM the HECM Program so it is: 1. Suitable. The lender must return any money you have paid so far for the financing. To report fraud or abuse in the Reverse Mortgage program, contact the Division of. Predatory lending is a term used to describe a wide range of unfair financial practices. Here are some resources that can help you avoid being a victim. Predatory lending is a term used to describe a wide range of unfair financial practices. Here are some resources that can help you avoid being a victim. This section will talk about reverse mortgages and home equity loans. Always be on the lookout for predatory lending. Reverse mortgage lenders cannot, by law, add even one penny to their fees or state regulators can fine and licences are at risk if a pattern of. subprime mortgage boom ultimately with disastrous consequences are turning to the reverse mortgage predatory practices involving reverse mortgage products. Our experienced reverse mortgage abuse attorneys can determine if the bank, lender, or reverse mortgage company has violated the law, as well as help you file a. What is Predatory Home Lending? · agree to buy something on the spot because the lender says it might not be available later, · agree to a home equity loan if you. A predatory mortgage is a needlessly expensive home loan that provides no financial benefit to the gorrower in return fo the extra costs. In many cases. Homeowners face problems with tangled title, servicing, reverse mortgages, foreclosure, and predatory lending. We help many homeowners with mortgage problems.

How Many Stitches For C Section

Your midwife will visit you at home to check your wound and remove your dressing, if you still have one. They will also remove the stitches or staples after 5–7. After the umbilical cord is cut and the placenta is removed, your uterus will be closed with dissolving stitches. Then your skin will be stitched or stapled. To speed up recovery after a cesarean delivery (C-section), people can try lifestyle and wellness methods, such as resting and gentle exercise. But research shows that using sutures instead of staples leads to fewer complications—namely wound separation. Types of c-section scars. How your c-section scar. 1. Depending on the length of the C-section opening there are about 10 to 15 stitches with permanent sutures for the inner layers. They usually take up to 6 weeks to dissolve completely. You may notice some knots at the edge of the wound, these will fall off as the stitches dissolve. If you. In a normal pregnancy, the baby is positioned head down in the uterus. Cesarean section. There are many reasons to deliver a baby by Cesarean section, such. Several conditions make a cesarean delivery more likely. These include: Abnormal fetal heart rate. The fetal heart rate during labor is a good sign of how well. Your midwife should also advise you on how to look after your wound. You'll usually be advised to: Non-dissolvable stitches or staples will usually be taken. Your midwife will visit you at home to check your wound and remove your dressing, if you still have one. They will also remove the stitches or staples after 5–7. After the umbilical cord is cut and the placenta is removed, your uterus will be closed with dissolving stitches. Then your skin will be stitched or stapled. To speed up recovery after a cesarean delivery (C-section), people can try lifestyle and wellness methods, such as resting and gentle exercise. But research shows that using sutures instead of staples leads to fewer complications—namely wound separation. Types of c-section scars. How your c-section scar. 1. Depending on the length of the C-section opening there are about 10 to 15 stitches with permanent sutures for the inner layers. They usually take up to 6 weeks to dissolve completely. You may notice some knots at the edge of the wound, these will fall off as the stitches dissolve. If you. In a normal pregnancy, the baby is positioned head down in the uterus. Cesarean section. There are many reasons to deliver a baby by Cesarean section, such. Several conditions make a cesarean delivery more likely. These include: Abnormal fetal heart rate. The fetal heart rate during labor is a good sign of how well. Your midwife should also advise you on how to look after your wound. You'll usually be advised to: Non-dissolvable stitches or staples will usually be taken.

Steri strips (also called butterfly stitches) are small strips of special medical tape that are used to hold two sections of skin together while healing after a. You have loose stitches, or your incision comes open. You have signs of hemorrhage (too much bleeding), such as: Heavy vaginal bleeding. This means that you. Many C-sections are planned ahead of time for women who've had a C-section You have loose stitches, or your incision comes open. You have signs of. stitches. This early skin-to-skin contact has been shown to have many benefits to moms and babies of vaginal births, such as the mother having greater. How to speed up recovery from a cesarean delivery. Medically reviewed by Valinda Riggins Nwadike, MD, MPH, OB/GYN. The average hospital stay after a C-section is 2 to 4 days, and keep in mind recovery often takes longer than it would from a vaginal birth. Most C-sections are unplanned because the need for one doesn't present itself until much closer to labor, or during it. stitches, and closes the abdominal incision And because incisions are often made in the "bikini" area, many C-section scars aren't even noticeable. Most C-sections are unplanned because the need for one doesn't present itself until much closer to labor, or during it. your womb is closed with dissolvable stitches, and the cut in your tummy is closed either with dissolvable stitches, or stitches or staples that need to be. Many women who have previously had a caesarean section can safely give birth vaginally. This is commonly referred to as 'vaginal birth after caesarean section'. Caesarean section, also known as C-section, cesarean, or caesarean delivery, is the surgical procedure by which one or more babies are delivered through an. The doctor closes the incisions with stitches or staples. What's Learn as much as you can about c-sections. Ask your provider about what to. Many C-section wound infections will be caused by bacteria that enter the Requesting subcuticular sutures rather than staples – staples are rarely used to. A caesarean section, or C-section, is major surgery The stitches may or may not need to be removed, depending on the type of suture material used. Many. The uterus is usually sutured with dissolvable stitches. Depending on your doctor's preference and your particular c-section procedure, the abdominal incision. Vaginal birth is much safer than a C-section for most women and babies. baby through, many women do have tears that need stitches. Most of these tears. C-section cuts often take time to heal and might get torn or stretched causing unbearable pain. In these cases visit the doctor immediately to redo the stitches. This type of suture is used for internal stitches to repair your uterus and other tissues below the skin. Absorbable sutures are becoming more popular for. This leaflet provides information on how to care for your wound following a caesarean section operation to deliver your baby.

Consolidating Debt Hurt Credit Score

Understand, however, that debt consolidation can hurt your credit score, at least in the short term. Does Credit Card Debt Consolidation Hurt Your Credit? Debt. (Payment history is the most important factor that determines your credit score.) The creditor could also end up sending your account to collections or suing. Debt consolidation also generally won't hurt your credit in the long run, and it may even help your scores grow. Debt Consolidating services can lower your monthly payments, but it can also cause a temporary dip in your credit score. Two common debt. The amount of debt you owe on your credit card is one of the biggest factors affecting your credit score. Generally, it's not a good idea to max out your. You can keep the card out and use it for emergencies. Why does debt consolidation program close credit cards? When you enroll in a debt consolidation program –. Debt consolidation can help you achieve a lower monthly payment and a lower interest rate for all your existing debt. The impact of debt consolidation on your credit score can be viewed from a short-term and long-term perspective. In the short term, applying for a consolidation. Debt consolidation will temporarily lower your credit score because you're accessing additional credit. Any lender will make a “hard inquiry” on your credit. Understand, however, that debt consolidation can hurt your credit score, at least in the short term. Does Credit Card Debt Consolidation Hurt Your Credit? Debt. (Payment history is the most important factor that determines your credit score.) The creditor could also end up sending your account to collections or suing. Debt consolidation also generally won't hurt your credit in the long run, and it may even help your scores grow. Debt Consolidating services can lower your monthly payments, but it can also cause a temporary dip in your credit score. Two common debt. The amount of debt you owe on your credit card is one of the biggest factors affecting your credit score. Generally, it's not a good idea to max out your. You can keep the card out and use it for emergencies. Why does debt consolidation program close credit cards? When you enroll in a debt consolidation program –. Debt consolidation can help you achieve a lower monthly payment and a lower interest rate for all your existing debt. The impact of debt consolidation on your credit score can be viewed from a short-term and long-term perspective. In the short term, applying for a consolidation. Debt consolidation will temporarily lower your credit score because you're accessing additional credit. Any lender will make a “hard inquiry” on your credit.

It should be emphasized that when provided by the right lenders and managed carefully, consolidation loans don't hurt your credit. They're designed to help you. When you pay debt down, your credit scores may go up. Check Your Rate. What Our Members Say. Does it hurt your credit score if you consolidate debt? In the long run, your credit score will likely improve by consolidating your debts and making. Your credit score may drop slightly directly after you consolidate debt. Over time, however, a responsible financial approach toward debt consolidation can. At the start, most debt consolidation methods have a negative effect on your credit score. They lower your score temporarily for several reasons. For example. Initially, a debt consolidation loan may cause a slight dip in your credit score. This is due to the hard inquiry on your credit report that lenders perform to. Bear in mind though your credit score will not get affected. It's better to continue paying than closing an account and it may hurt your score. Many people wonder, “Does debt consolidation affect your credit?” The short answer is yes. A debt consolidation loan may hurt your credit score. However, it. A consolidation loan will hurt your credit score in the initial enquiry, but can actually improve it provided you make on-time payments. A Debt Management Plan. May offer lower interest rates than what you're currently paying. Can reduce the size — and number — of monthly payments. Could improve your credit score if. For one, when you take out a new loan, your credit score could suffer a minor hit, which could affect whether you qualify for other new loans. Depending on how. Consolidation often significantly lowers the percentage of total credit you're using (called credit utilization) by paying off cards and loans. This factor. Credit card debt consolidation is a good way to get a handle on monthly payments and decrease debt, but it must be done right if you want to do it without. Check my loan options. Check your rate with no impact to your credit scoreOpens Dialog. The Annual Percentage Rate (APR) shown is for a personal loan of at. Credit card consolidation can hurt your score initially and temporarily, but is designed to help your credit in the long run. When you apply for a credit card. From balance transfer credit cards to personal loans, there are a number of credit card debt consolidation options. If you make your payments regularly, a debt consolidation loan will not hurt your credit score. There are many pros to consolidating your debt. A debt. How to get a debt consolidation loan online ; Get your rate. It takes less than 5 minutes to check your rate—and it won't affect your credit score.¹. Upstart. Having a debt consolidation loan on your credit report won't look different to any other kind of loan. As long as you make your repayments on time, it won't.

1 2 3 4 5