blue-host.ru Market

Market

Real Estate Crowd Funding Sites

Best Real Estate Crowdfunding Platforms for Accredited Investors · 1. EquityMultiple · 2. CrowdStreet · 3. AcreTrader · 4. HoneyBricks · 5. CityVest. CityVest. Real estate crowdfunding platforms like Fundrise and HERE offer accessible avenues for diversified real estate investments, appealing to a. Arrived makes investing in residential real estate and vacation rentals highly accessible with a minimum investment of just $ Real estate crowdfunding is a way for investors to pool their money together online and invest in real estate projects that they might not have had access to. Best Real Estate Crowdfunding Platforms for September · Our Top Picks · Fundrise · EquityMultiple · YieldStreet · CrowdStreet · RealtyMogul · Arrived · DLP. Real estate crowdfunding platforms offer everything from fix-and-flip homes to multi-family apartment buildings to self-storage and car wash facilities. Boasting a minimal initial investment of just $10 and modest yearly charges, Fundrise stands out as a top contender among real estate crowdfunding platforms. Investor research and tools that cut through the hype and clutter of real estate crowdfunding investing. The Real Estate Crowdfunding Review includes. Best Real Estate Crowdfunding Platforms for Investing · CrowdStreet · RealtyMogul · Fundrise · First National Realty Partners · EquityMultiple. EquityMultiple. Best Real Estate Crowdfunding Platforms for Accredited Investors · 1. EquityMultiple · 2. CrowdStreet · 3. AcreTrader · 4. HoneyBricks · 5. CityVest. CityVest. Real estate crowdfunding platforms like Fundrise and HERE offer accessible avenues for diversified real estate investments, appealing to a. Arrived makes investing in residential real estate and vacation rentals highly accessible with a minimum investment of just $ Real estate crowdfunding is a way for investors to pool their money together online and invest in real estate projects that they might not have had access to. Best Real Estate Crowdfunding Platforms for September · Our Top Picks · Fundrise · EquityMultiple · YieldStreet · CrowdStreet · RealtyMogul · Arrived · DLP. Real estate crowdfunding platforms offer everything from fix-and-flip homes to multi-family apartment buildings to self-storage and car wash facilities. Boasting a minimal initial investment of just $10 and modest yearly charges, Fundrise stands out as a top contender among real estate crowdfunding platforms. Investor research and tools that cut through the hype and clutter of real estate crowdfunding investing. The Real Estate Crowdfunding Review includes. Best Real Estate Crowdfunding Platforms for Investing · CrowdStreet · RealtyMogul · Fundrise · First National Realty Partners · EquityMultiple. EquityMultiple.

While there are dozens of crowdfunding platforms available to you, some of the more popular platforms include Fundrise, Origin Investments, and RealtyMogul. The. Best Real Estate Crowdfunding Sites · CrowdStreet. Fees: % to % for CrowdStreet funds; other fees vary by offering; Minimum Investment: $25,; Average. Real estate crowdfunding platforms connect investors and builders. Builders promote their projects on the platform, and investors invest in those projects. It's more relevant to the average consumer by providing an opportunity to invest in the real estate market through crowdfunding platforms, like Crowdtsreet and. Crowdstreet is a leading commercial real estate investing platform. Join today to view our CRE opportunities available exclusively to accreditor investors. Invest in world-class private market investments like real estate, venture capital, and private credit. Fundrise is America's largest direct-access. Real estate crowdfunding platforms offer everything from fix-and-flip homes to multi-family apartment buildings to self-storage and car wash facilities. Real estate crowdfunding allows retail investors to invest in property through fractional equity investments or making loans without buying a building. How Real Estate Crowdfunding Works? · Equity Investments: In equity-based crowdfunding, investors buy shares in a real estate project and become partial owners. Though crowdfunded-based real estate investing may appear simple, it is, in fact, quite complex. At its most basic level, crowdfunding is pooling a large number. The best Real estate crowdfunding platforms · Rendity · Crowdestate · StockCrowd IN · Urbanitae · Inrento · dagobertinvest · Walliance · CITESIA · France. RealtyMogul simplifies commercial real estate investing through the use of cutting-edge technology giving Members access to commercial real estate opportunities. Groundfloor presents a compelling opportunity for both novice and experienced investors to engage in fractional real estate investing with a minimum commitment. Leading Real Estate Crowdfunding Platforms · CrowdStreet: It provides direct real estate investing opportunities, connecting accredited investors with a broad. Fundrise is our best overall crowdfunding platform. Pros. Open to all investor types; Low minimum investment; Easy-to-use website; Access to IRA accounts. My favorite private real estate crowdfunding platform is Fundrise due to its diversified funds. Fundrise invests primarily in residential and industrial. Leading Real Estate Crowdfunding Platforms · CrowdStreet: It provides direct real estate investing opportunities, connecting accredited investors with a broad. Below you will find a list of all main real estate crowdfunding platforms in Europe and a description of key players by country. 7 Top Real Estate Crowdfunding or Investing Platforms · 1. Upright (formerly Fund That Flip) · 2. Yieldstreet · 3. EquityMultiple · 4. Streitwise · 5. Real estate crowdfunding is a way for investors to pool their money together online and invest in real estate projects that they might not have had access to.

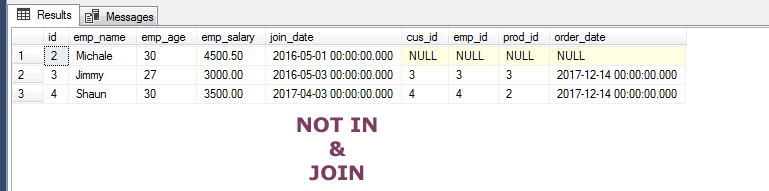

Sql Is Not

The NOT EQUAL operator ( or!=) is indispensable for querying data that does not meet a certain condition. It enables the exclusion of specific rows from. The AND and OR operators are used to filter records based on more than one condition. The NOT operator displays a record if the condition(s) is NOT TRUE. The SQL NOT EQUAL operator is used to compare two values and return true if they are not equal. It is represented by "" and "!=". The difference between these. SQL Tutorial. SQL HOME SQL Intro SQL Syntax SQL Select SQL Select Distinct SQL Where SQL Order By SQL And SQL Or SQL Not SQL Insert Into SQL Null Values SQL. The SQL IN Operator. The IN operator allows you to specify multiple values in a WHERE clause. · NOT IN. By using the NOT keyword in front of the IN operator, you. In this tutorial, you will learn how to use the SQL NOT operator to negate a Boolean expression in the WHERE clause of the SELECT statement. NOT is a logical operator in SQL that you can put before any conditional statement to select rows for which that statement is false. Here's what. When you use the IN operator, the SQL language first gets all of the values that match. In this case, the parameters are any record that starts with the. The SQL NOT operator is a logical operator used to negate a Boolean condition. It reverses the truth value of a condition, changing a true condition into false. The NOT EQUAL operator ( or!=) is indispensable for querying data that does not meet a certain condition. It enables the exclusion of specific rows from. The AND and OR operators are used to filter records based on more than one condition. The NOT operator displays a record if the condition(s) is NOT TRUE. The SQL NOT EQUAL operator is used to compare two values and return true if they are not equal. It is represented by "" and "!=". The difference between these. SQL Tutorial. SQL HOME SQL Intro SQL Syntax SQL Select SQL Select Distinct SQL Where SQL Order By SQL And SQL Or SQL Not SQL Insert Into SQL Null Values SQL. The SQL IN Operator. The IN operator allows you to specify multiple values in a WHERE clause. · NOT IN. By using the NOT keyword in front of the IN operator, you. In this tutorial, you will learn how to use the SQL NOT operator to negate a Boolean expression in the WHERE clause of the SELECT statement. NOT is a logical operator in SQL that you can put before any conditional statement to select rows for which that statement is false. Here's what. When you use the IN operator, the SQL language first gets all of the values that match. In this case, the parameters are any record that starts with the. The SQL NOT operator is a logical operator used to negate a Boolean condition. It reverses the truth value of a condition, changing a true condition into false.

This SQL tutorial explains how to use the SQL IS NOT NULL condition with syntax and examples. The IS NOT NULL condition is used in SQL to test for a. A WHERE IS NULL clause returns rows with columns that have NULL values. WHERE IS NOT NULL returns rows with column values that are not NULL. is the standard SQL notation for “not equal”.!= is an alias, which is converted to at a very early stage of parsing. Hence, it is not possible to. Map type is not supported. For complex types such array/struct, the data types of fields must be orderable. Examples: > SELECT 1!. The NOT command is used with WHERE to only include rows where a condition is not true. The following SQL statement selects all fields from ". To not show duplicates in your SQL query, you can use the DISTINCT keyword. This keyword will return only the distinct (unique) values in the specified column. The SQL IN Operator. The IN operator allows you to specify multiple values in a WHERE clause. · NOT IN. By using the NOT keyword in front of the IN operator, you. SQL Tutorial. SQL HOME SQL Intro SQL Syntax SQL Select SQL Select Distinct SQL Where SQL Order By SQL And SQL Or SQL Not SQL Insert Into SQL Null Values SQL. The SQL EXISTS keyword is used to check if at least one value is found in a subquery. It doesn't work with a literal list of values like the IN keyword does. The LIKE and NOT LIKE expressions allow you to specify a set of similar values to be either returned or excluded from a query's results. The SQL NOT condition (sometimes called the NOT Operator) is used to negate a condition in the WHERE clause of a SELECT, INSERT, UPDATE, or DELETE statement. The SQL "Not Equals To" operator, denoted as "", "!=", or "NOT =", is used to compare values in a database table and retrieve rows where a specific column's. The SQL AND operator selects data if all conditions are TRUE. For example, -- select the first_name and last_name of all customers -- who live in 'USA' and. Well organized and easy to understand Web building tutorials with lots of examples of how to use HTML, CSS, JavaScript, SQL, Python, PHP, Bootstrap, Java. The SQL NOT Operator. SQL NOT is a logical operator/connective used to negate a condition or Boolean expression in a WHERE clause. That is, TRUE becomes FALSE. The IS NULL operator is used to test for empty values (NULL values). The following SQL lists all customers with a NULL value in the "Address" field. SQL Server WHERE with AND, OR, and NOT -- the best examples. A WHERE conditions can be combined with AND, OR, and NOT. These logical conditions always. The arithmetic operators +, -, *, / for addition, subtraction, multiplication, and division are old friends, but you might not have encountered % before in an. Learn how to use AND, OR, and NOT operators in SQL WHERE clause. This SQL tutorial will help beginners understand SQL logical operators and their usage. Learn how to use AND, OR, and NOT operators in SQL WHERE clause. This SQL tutorial will help beginners understand SQL logical operators and their usage.

Goldman Money Market Fund

The Fund seeks to maximize current income to the extent consistent with the preservation of capital and the maintenance of liquidity by investing exclusively in. Find the latest Goldman Sachs Trust - Investor Money Market Fund (FMKXX) stock quote, history, news and other vital information to help you with your stock. A money market mutual fund is a fixed income mutual fund that invests in debt instruments like certificates of deposits (CDs), U.S. Treasury notes. Money market funds. A money market fund is an open-ended fund that invests in short-term fixed-income securities such as US Treasury bills and. Although the Goldman Sachs money market funds seek to preserve a stable net investment in a money market fund is different from an investment in. Fidelity Investments Money Market*. FNSXX. Retail. Goldman Sachs Financial Square Prime Obligations Fund*. FPOXX. Institutional. Goldman Sachs Investor Money. Money Market Funds: Financial Square Money Market Fund and Financial Square Prime Obligations Fund. You could lose money by investing in the Fund. Because. Get Goldman Sachs Investor Money Market Fund Class A (FMEXX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Money market accounts offer APYs that are generally lower than ones you'd find with certificates of deposit, but money market accounts offer access typical CDs. The Fund seeks to maximize current income to the extent consistent with the preservation of capital and the maintenance of liquidity by investing exclusively in. Find the latest Goldman Sachs Trust - Investor Money Market Fund (FMKXX) stock quote, history, news and other vital information to help you with your stock. A money market mutual fund is a fixed income mutual fund that invests in debt instruments like certificates of deposits (CDs), U.S. Treasury notes. Money market funds. A money market fund is an open-ended fund that invests in short-term fixed-income securities such as US Treasury bills and. Although the Goldman Sachs money market funds seek to preserve a stable net investment in a money market fund is different from an investment in. Fidelity Investments Money Market*. FNSXX. Retail. Goldman Sachs Financial Square Prime Obligations Fund*. FPOXX. Institutional. Goldman Sachs Investor Money. Money Market Funds: Financial Square Money Market Fund and Financial Square Prime Obligations Fund. You could lose money by investing in the Fund. Because. Get Goldman Sachs Investor Money Market Fund Class A (FMEXX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Money market accounts offer APYs that are generally lower than ones you'd find with certificates of deposit, but money market accounts offer access typical CDs.

On September 9, , Goldman Sachs and Drexel Hamilton announced the launch of the Drexel Hamilton share class of the GS Financial Square Government Money. Our Money Markets team manages more than $ billion in assets. We collaborate with intermediary, hedge fund, institutional, corporate, and wealth management. Sweep Money Market Mutual Fund & Bank Deposit Sweep Product Rates & Bank Lists ; GOLDMAN SACH, GOLDMAN SACHS FS FED FND ADMIN, %, $ ,, U Discover a wide range of competitive money market rates and other savings options from Bankrate. Compare and open one today to maximize your savings. The Fund seeks to maximize current income to the extent consistent with the preservation of capital and the maintenance of liquidity. GOLDMAN SACHS INVESTOR MONEY MARKET FUND CLASS A- Performance charts including intraday, historical charts and prices and keydata. Find the latest performance data chart, historical data and news for Goldman Sachs Investor Money Market Fund Class I (FMJXX) at blue-host.ru Money Market Funds · Launch With GS is a $1 billion investment strategy based on our data-driven that aims to narrow investing gaps by directing capital and. Goldman Sachs Financial Square Funds. Goldman Sachs Financial Square Prime Obligations Fund. Goldman Sachs Financial Square Money Market Fund. The Goldman Sachs Investor Tax-Exempt Money Market Fund (the “Fund”) seeks to maximize current income to the extent consistent with the preservation of capital. Get Goldman Sachs Investor Money Market Fund Class I (FMJXX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Get FMEXX mutual fund information for Goldman-Sachs-Investor-Money-Market-Fund-Class-A, including a fund overview,, Morningstar summary, tax analysis. Contributions to this Individual Fund Investment Option will be invested solely in the Goldman Sachs Financial Square℠ Government Money Market Fund. Fund Name Inception. Ticker. Exp. Ratio. 1 Year 3 Year 5 Year 10 Year. Since. Incep. Goldman Sachs Investor Money Market Fund Class A ( /16). FMEXX. The Fund pursues its investment objective by investing in securities issued or guaranteed by the United States or certain US government agencies or. Performance charts for Goldman Sachs Financial Square Money Market Fund (FSMXX - Type MMF) including intraday, historical and comparison charts. Cash Sweeps - Money Market Funds ; Allspring Government Money Market Fund - Sweep Class, · %, % ; Goldman Sachs Financial Square Government Fund, · %. Performance charts for Goldman Sachs Investor Money Market Fund (FMGXX - Type MMF) including intraday, historical and comparison charts, technical analysis. Mosaic is an investment platform provided through Goldman Sachs & Co. LLC. (GS) that delivers digital products, expertise and data & execution services.

Investment Banking Wealth Management

Wealth Management offers personalized perspectives, advice, and offerings tailored to the unique needs of individuals, family offices, foundations. Our Solutions by Client · Endowment & Foundation Services · Family Offices · Investment Management · Investor Solutions · Private Banking. Investment banking is more about advising companies on transactions such as M&A deals, equity and debt deals, and restructuring. We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists. The mass affluent investor segment has been underserved by traditional wealth managers and retail banks. This market gap has spurred growth of new fintechs. Realize your financial goals with disciplined investment counsel and wealth planning services tailored to your unique needs. RBC Private Banking. Enjoy a. IB typically has better initial salary but Wealth Management typically has higher future income potential and ability to own client. Great investment advice doesn't exist in a vacuum. Our service looks at all your financial needs, from wealth planning to investing to banking. We like to. Wealth management, on the other hand, typically caters to providing investment-related advice and services to banking clients. The types of clients also differ. Wealth Management offers personalized perspectives, advice, and offerings tailored to the unique needs of individuals, family offices, foundations. Our Solutions by Client · Endowment & Foundation Services · Family Offices · Investment Management · Investor Solutions · Private Banking. Investment banking is more about advising companies on transactions such as M&A deals, equity and debt deals, and restructuring. We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists. The mass affluent investor segment has been underserved by traditional wealth managers and retail banks. This market gap has spurred growth of new fintechs. Realize your financial goals with disciplined investment counsel and wealth planning services tailored to your unique needs. RBC Private Banking. Enjoy a. IB typically has better initial salary but Wealth Management typically has higher future income potential and ability to own client. Great investment advice doesn't exist in a vacuum. Our service looks at all your financial needs, from wealth planning to investing to banking. We like to. Wealth management, on the other hand, typically caters to providing investment-related advice and services to banking clients. The types of clients also differ.

Crédit Agricole CIB's Private Investment Banking division, which specialises in wealth management, supports high net worth individuals and family holding. Our Wealth Management courses and credentials develop a range of competencies, from client-servicing to advanced client-discovery methods. While private banking and other types of wealth management may offer the same services to help clients reach their financial goals, the degree of. Certain advisory products may be offered through J.P. Morgan Private Wealth Advisors LLC (JPMPWA), a registered investment adviser. Trust and Fiduciary. The Asset & Wealth Management group at Raymond James provides high-quality financial and strategic advice to firms undergoing transformational events. Our preeminent global Investment Banking business is built on a culture of enduring partnerships and a commitment to delivering exceptional execution. Citizens Private Wealth for clients with significant wealth and complex needs. Citizens Private Wealth has advisors and specialists who can help you navigate. U.S. Bancorp Wealth Management provides retirement and financial planning, investment management, trust and fiduciary services and private banking. We tailor the construction of your overall portfolio to your specific requirements. This process includes strategic and tactical asset allocation, and specific. This comprehensive guide breaks down the similarities and differences between asset management and investment banking and explores the career paths they offer. Wealth Management to Investment Banking: When to Make the Move, Whether It's Worth It, and How to Recruit and Win IB Roles. A leading provider of M&A and capital raising services to the asset & wealth management industry. No. 1 Ranked asset & wealth management industry M&A advisor. Our Canadian team consists of 37 investment banking professionals. David Atkinson Managing Director, Investment Banking Mergers & Acquisitions. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is. Your investment advisor will make your money work for you so you can relax and live life to the fullest! Our expertise spans private equity, real assets, private credit, hedge funds and digital assets. solution. Impact Investing. Our Investing with Impact platform. Services – The J.P. Morgan side of the company is responsible for its investment banking, asset management, private banking, and private wealth management. Building and preserving wealth at every life stage · Wealth Planning · Banking & Borrowing · Investment Management · Trust & Estate · Strategic Philanthropy · Tax. Our capabilities · Wealth Management · Asset Management · Investment Bank · Corporate & Institutional Clients. Through our unique set-up, clients are able to draw on exclusive investment ideas through dedicated portfolio specialists, access award-winning Wealth.

What Is A Sovereign Wealth Fund

/GettyImages-1198972656-63e9bf6a60c545f9acde5e802985bec7.jpg)

A sovereign wealth fund (SWF) is a fund owned by a state composed of financial assets such as stocks, bonds, property or other financial instruments. Social wealth funds are generally defined as “collectively held financial funds, fully owned by the public and used for the benefit of society as a whole. Sovereign Investment Funds (SIF) are state-owned and backed investors including Sovereign Wealth Funds (SWF), state-backed investment arms, and public pension. Largest sovereign wealth funds ; Government Pension Fund Global · $ · Norway ; China Investment Corporation · $ · China ; Abu Dhabi Investment Authority. In this deep-dive article, we look at why Sovereign Wealth Funds are playing a growing role investing in sustainable projects in the Middle East and further. 1. Norway Government Pension Fund Global, $1,,,, · 2. China Investment Corporation, $1,,,, · 3. SAFE Investment Company. Sovereign wealth funds represent a large and growing pool of savings. An increasing number of these funds are owned by natural resource–exporting countries. What is a Sovereign Wealth Fund? There is no single, universally accepted definition of a SWF. This appendix will use the term. SWF to mean a government. A sovereign wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, and. A sovereign wealth fund (SWF) is a fund owned by a state composed of financial assets such as stocks, bonds, property or other financial instruments. Social wealth funds are generally defined as “collectively held financial funds, fully owned by the public and used for the benefit of society as a whole. Sovereign Investment Funds (SIF) are state-owned and backed investors including Sovereign Wealth Funds (SWF), state-backed investment arms, and public pension. Largest sovereign wealth funds ; Government Pension Fund Global · $ · Norway ; China Investment Corporation · $ · China ; Abu Dhabi Investment Authority. In this deep-dive article, we look at why Sovereign Wealth Funds are playing a growing role investing in sustainable projects in the Middle East and further. 1. Norway Government Pension Fund Global, $1,,,, · 2. China Investment Corporation, $1,,,, · 3. SAFE Investment Company. Sovereign wealth funds represent a large and growing pool of savings. An increasing number of these funds are owned by natural resource–exporting countries. What is a Sovereign Wealth Fund? There is no single, universally accepted definition of a SWF. This appendix will use the term. SWF to mean a government. A sovereign wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, and.

The fund's formal name is the Government Pension Fund Global. About the fund Governance model. Global SWF is a Data Platform that tracks over Sovereign Wealth Funds (SWFs) and Public Pension Funds (PPFs) providing insights on the top Global SWF is a Data Platform that tracks over Sovereign Wealth Funds (SWFs) and Public Pension Funds (PPFs) providing insights on the top In the United Arab Emirates, there are at least three SWFs: Mubadala, Emirates Investment Authority (EIA) and the most powerful of them, the Abu Dhabi. A sovereign wealth fund is owned by the general government, which includes both central government and sub-national governments. Includes investments in foreign. Sovereign wealth funds (SWFs), broadly defined as public investment agencies which manage part of the (foreign) assets of national states, have recently. Co-investments, in which the sovereign wealth fund (SWF) invests alongside a private equity partner; this offers enormous potential as an SWF does not pay the. A Sovereign Wealth Fund (SWF) is a state-owned investment fund or entity that is commonly established from · Balance of payments surpluses · Official foreign. Sovereign Wealth Fund (SWF) is an investment fund controlled by the government of a country with trade surpluses and abundant foreign monetary reserves. A Sovereign Wealth Fund (SWF) is an investment vehicle owned by a national or regional government that buys, holds, and sells securities and/or assets on. A sovereign wealth fund (SWF), also known as a social wealth fund, is the surplus money that a country accrues over time. The government-backed pool of funds is. This paper proposes some basic elements of a conceptual framework to create a system of checks and balances to help ensure that the sovereign wealth funds do. IFSWF has been setting governance standards for sovereign wealth funds since It now represents and facilitates knowledge sharing between approximately. With assets amounting to $8 trillion, sovereign wealth funds (SWFs) own on average 5% of all listed equities globally, yet, little is known about them. SWFs. Home / Special Projects / Sovereign Wealth Fund. The Sovereign Wealth Fund (SWF) of Papua New Guinea is a national fund that has been established to support the. Quick Reference. An investment fund that is owned by a sovereign nation and managed by a central bank, state pension fund, or official investment company. Most. SWFs are typically funded from one of two broad sources. Those funded from revenue windfalls from commodities, such as Norway's Government Pension Fund - Global. Sovereign Wealth Funds maps the global footprints of these financial institutions, examining their governance and investment management, and issues of domestic. Are sovereign wealth funds regulated? In a manner of speaking, yes. Sovereign wealth funds are creations of statute and regulation and are, therefore, regulated. 1. Norway Government Pension Fund Global, $1,,,, · 2. China Investment Corporation, $1,,,, · 3. SAFE Investment Company.

Good Credit Card For No Credit History

Best for a limited credit history: Capital One QuicksilverOne Cash Rewards Credit Card card is specifically advertised to people without a credit history. Applied Bank Secured Visa® Gold Preferred® Credit Card · OpenSky® Plus Secured Visa® Credit Card · Revenued Business Card · Revvi Visa® Credit Card · Self - Credit. Best CC to have with no credit history? · Discover It. · Chase Freedom Unlimited. · Chase Freedom Rise. · Chase Freedom Flex. · Capital One. Alina Comoreanu · OpenSky® Plus Secured Visa® Credit Card: Best Overall · Petal® 2 Visa® Credit Card: Best for No Annual Fee · Capital One Quicksilver Secured Cash. Learn how to get your first credit account and build a credit history that is reported on a credit report. Credit can help you get a loan, credit card, job. Add to compareBankAmericard® credit card. Add to compare. BankAmericard When handled responsibly, a credit card can help you build your credit history. No credit score is required to apply for Discover it® Student Cash Back, Discover it® Student Chrome, and Discover it® Secured Credit Card. The Home Trust Secured Visa is considered to be one of the best secured credit cards in Canada. It's actually been voted the best secured card for the last 3. The best credit card for no credit and no bank account is Petal® 2 Visa® Credit Card. This card offers 1 - % cash back on purchases and has a $0 annual fee. Best for a limited credit history: Capital One QuicksilverOne Cash Rewards Credit Card card is specifically advertised to people without a credit history. Applied Bank Secured Visa® Gold Preferred® Credit Card · OpenSky® Plus Secured Visa® Credit Card · Revenued Business Card · Revvi Visa® Credit Card · Self - Credit. Best CC to have with no credit history? · Discover It. · Chase Freedom Unlimited. · Chase Freedom Rise. · Chase Freedom Flex. · Capital One. Alina Comoreanu · OpenSky® Plus Secured Visa® Credit Card: Best Overall · Petal® 2 Visa® Credit Card: Best for No Annual Fee · Capital One Quicksilver Secured Cash. Learn how to get your first credit account and build a credit history that is reported on a credit report. Credit can help you get a loan, credit card, job. Add to compareBankAmericard® credit card. Add to compare. BankAmericard When handled responsibly, a credit card can help you build your credit history. No credit score is required to apply for Discover it® Student Cash Back, Discover it® Student Chrome, and Discover it® Secured Credit Card. The Home Trust Secured Visa is considered to be one of the best secured credit cards in Canada. It's actually been voted the best secured card for the last 3. The best credit card for no credit and no bank account is Petal® 2 Visa® Credit Card. This card offers 1 - % cash back on purchases and has a $0 annual fee.

If you have a bad credit score or no credit history, the Neo Secured Mastercard gives you a way to start improving your score while earning up to 15% cashback. Sort cards by: Genius Rating. Annual Fee. Welcome Bonus. you have not gotten a loan from a bank or credit union. Without a credit history, it can be harder to get a job, an apartment, or even a credit card. It sounds. Best for prequalification: Credit One Bank® Platinum Visa® for Rebuilding Credit. Here's why: If you have your heart set on an unsecured credit card but you're. Best Credit Cards for No Credit of August · Discover it® Student Chrome · Discover it® Secured Credit Card · BankAmericard® Secured Credit Card · Bank of. Combined credit builder account and secured card products to help you build credit and save* money (minus interest and fees) No credit check. · No credit check. With a small deposit, usually $ or less, you can get a secured credit card. These are credit cards for people with no credit history. The deposit secures. You might consider applying for a secured credit card, student credit card or retail store credit card to help establish and build your credit. Find a card that. Discover it® Student Cash Back: Best overall. · Discover it® Student Chrome: Best for gas and dining. · Capital One Quicksilver Student Cash Rewards Credit Card. Secured Chime Credit Builder Visa® Credit Card · NetSpend® Visa® Prepaid Card · Group One Platinum · The First Progress Platinum Elite Mastercard® Secured Credit. Chase Freedom Rise®: Best for No-deposit starter card: Solid rewards on everything · Discover it® Student Chrome: Best for Student cards: Simplicity and value. Consider a secured or student credit card or secured loan · You can become an authorized user on a credit card account, or get a co-signer · Remember that. Get a Discover credit card with no credit score required to apply · Student Cash Back Credit Card · Student Chrome Credit Card · Secured Credit Card. Credit-building cards. These are a great choice if you have no credit history and are also perfect for people rebuilding their credit. · Student credit cards. Building a credit history is important for newcomers to Canada. It's easy to apply for a CIBC credit card and earn rewards when making everyday purchases. Credit cards for no credit · OpenSky® Secured Credit Visa® Card · OpenSky® Secured Credit Visa® Card · Min. deposit · Regular purchase APR · Annual fee · Rewards rate. First Progress Platinum Elite Secured Mastercard: The First Progress Platinum Elite Secured Mastercard requires no credit history or minimum credit score for. First Progress Platinum Elite Secured Mastercard: The First Progress Platinum Elite Secured Mastercard requires no credit history or minimum credit score for. For people with bad credit, secured credit cards are a great way to get back on track. By making a deposit, which serves as collateral, you reduce the risk for. Limited or no credit history credit card offers from our partners · INTRO OFFER: Unlimited Cashback Match for all new cardmembers - only from Discover. · Earn 2%.

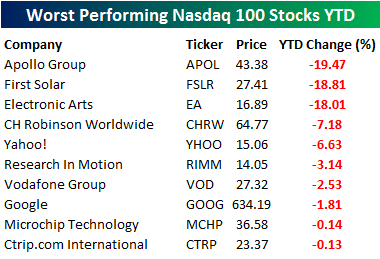

Nasdaq 100 Ytd

Find the latest information on NASDAQ (NDX), including data, charts, related news, and more from blue-host.ru YTD, 1 Month, 3 Months, 6 Months, 1 Year, 3 Years, 5 Years, Since Inception. Total Return NAV (%), %, %, %, %, blue-host.ru%, blue-host.ru%, blue-host.ru%, %. What is the YTD return on the Nasdaq ? The Nasdaq YTD return is %. ; What is the 6 month return on the Nasdaq ? The Nasdaq 6 month return is. NAV Total Return as of 30/Aug/ YTD: %. Overview; Performance; Fund Facts; Holdings; Literature. Overview. INVESTMENT OBJECTIVE. The Fund seeks to track. The Fund is designed to offer regular distributions through a strategy that seeks attractive total return with less volatility than the Nasdaq Index. The NASDAQ is an index that is constituted by of the largest companies listed on the NASDAQ stock exchange, which is the second largest in the world. Get NASDAQ Index .NDX:NASDAQ) real-time stock quotes, news, price Key Stats. YTD % Change; 1 Year % Change Summary News Profile. KEY. YTD Return: INDEX TICKERS. Price Return: Total Return: Net Total Return: TOP The Nasdaq Index includes of the largest domestic and. So far in (YTD), the Nasdaq index has returned an average %. Year, Return. , %. , %. , %. , %. , %. Find the latest information on NASDAQ (NDX), including data, charts, related news, and more from blue-host.ru YTD, 1 Month, 3 Months, 6 Months, 1 Year, 3 Years, 5 Years, Since Inception. Total Return NAV (%), %, %, %, %, blue-host.ru%, blue-host.ru%, blue-host.ru%, %. What is the YTD return on the Nasdaq ? The Nasdaq YTD return is %. ; What is the 6 month return on the Nasdaq ? The Nasdaq 6 month return is. NAV Total Return as of 30/Aug/ YTD: %. Overview; Performance; Fund Facts; Holdings; Literature. Overview. INVESTMENT OBJECTIVE. The Fund seeks to track. The Fund is designed to offer regular distributions through a strategy that seeks attractive total return with less volatility than the Nasdaq Index. The NASDAQ is an index that is constituted by of the largest companies listed on the NASDAQ stock exchange, which is the second largest in the world. Get NASDAQ Index .NDX:NASDAQ) real-time stock quotes, news, price Key Stats. YTD % Change; 1 Year % Change Summary News Profile. KEY. YTD Return: INDEX TICKERS. Price Return: Total Return: Net Total Return: TOP The Nasdaq Index includes of the largest domestic and. So far in (YTD), the Nasdaq index has returned an average %. Year, Return. , %. , %. , %. , %. , %.

The Nasdaq Index (NDX®) defines today's modern-day industrials—comprised of of the largest and most innovative non-financial companies listed on the. Interactive chart showing the YTD daily performance of the NASDAQ stock market index. Performance is shown as the percentage gain from the last trading day. The S&P rose 1%, the Nasdaq gained %, while the Dow Jones hit a new record close, adding points. The Personal Consumption Expenditures (PCE). YTD 1YR 3YR 5YR 10YR. Frequency: Monthly. Compare Chart | Fund Facts Search The NASDAQ Index includes of the largest non-financial companies. Year to date price returns of the individual companies in the Nasdaq Index. The return is calculated using the closing price of the last trading day of the. NAV Total Return as of Aug 30, YTD: %. As announced on July 12, the Fund underwent a stock split. The Fund began trading on a split. NASDAQ Index (NASDAQ Calculation) | historical charts for NDX to YTD; 1 Y; 3 Y. $; %. Advanced Charting Compare. Compare to Benchmark: DJIA; S&P (YTD returns as of 8/31/24): JP Morgan Income Fund (JPMIX), YTD return Analysis. Brian Gilmartin. 14 hours ago. 1 Stock to Buy, 1 Stock to Sell This Week. NASDAQ Composite Index ; Open. 17, Previous Close ; YTD Change. %. 12 Month Change ; Day Range · 52 Wk Range. The NASDAQ (^NDX) is a stock market index made up of equity securities issued by of the largest non-financial companies listed on the NASDAQ. NASDAQ Index (NASDAQ Calculation). Nasdaq. market open. 19, NDX YTD Change. %. 12 Month Change. %. Day Range19, - 19, YTD RETURN. %. DAY RANGE. 19,–19, 52 WEEK RANGE. 14, The NASDAQ Index is a modified capitalization-weighted index of the NDX; Historical Data. NASDAQ (NDX) Historical Data. 1M 6M YTD 1Y 5Y MAX. Download historical data. Date. Close/Last. Open. High. Low. 08/30/ 19, NASDAQ YTD Performance: Interactive chart showing the YTD daily performance of the NASDAQ stock market Dow Jones - Year Historical · NASDAQ to Dow. Nasdaq Index® Performance. The Nasdaq® and S&P are two of the Performance Matters. Nasdaq® vs. S&P. 1D 5D 1M 6M YTD 1Y 5Y MAX. Created. Discover historical prices for ^NDX stock on Yahoo Finance. View daily, weekly or monthly format back to when NASDAQ stock was issued. Previous Close · YTD High · YTD Low · Volatility (14d) · Stochastic %K (14d) · Weighted Alpha · 5-Day Change. Find the composition of Index NASDAQ (NDX) on Nasdaq in real time. Sort by weights and variations 1 day, or one week. %. YTD. %. 1 Year. %. Recent News. MarketWatch. Dow Jones. Read NASDAQ Index (NASDAQ Calculation), 19,, , %. S&P MidCap HXQ provides investors with direct exposure to of the largest US and international non-financial companies listed on the NASDAQ Stock Market.

Most Profitable Things To Sell Online

With that massive number of tech users comes a lot of used tech products, many of which you can resell for a profit. After all, the global used smartphone. Which Products Have the Highest Profit Margins? · Jewelry · Beauty products · Kids' toys · Women's and men's apparel · Designer sunglasses · Eco-friendly. Top Five Most Profitable Products to Sell Online · 1. Apparel — The Stylishly Profitable Venture · 2. Online Courses — The Future of Education and Profitability. Digital Product Ideas | Digital Products to Sell on Etsy · abdalla ; 13 Super Profitable Things to Make and Sell For Extra Money | Make Money. Mirakl's products are built to make these complex connections simple and scalable to drive a profitable and sustainable commerce business. Adopt the most. The online jewelry market is more successful than you might expect, considering the nature of buying online means customers can't inspect products before. Bookshelves, bookcases, and bookends are all selling well and usually have high profit margins. If you add this to your eCommerce or wholesale catalog, make. Clothing, Shoes & Jewelry will always make the list of best products to sell on Amazon for beginners and many other online marketplaces. Currently, Amazon. Boost Profitability with these Most Demanded Products · Start Online Clothing Business For Fashion Lovers · Start Online Cell Phones Selling Business For. With that massive number of tech users comes a lot of used tech products, many of which you can resell for a profit. After all, the global used smartphone. Which Products Have the Highest Profit Margins? · Jewelry · Beauty products · Kids' toys · Women's and men's apparel · Designer sunglasses · Eco-friendly. Top Five Most Profitable Products to Sell Online · 1. Apparel — The Stylishly Profitable Venture · 2. Online Courses — The Future of Education and Profitability. Digital Product Ideas | Digital Products to Sell on Etsy · abdalla ; 13 Super Profitable Things to Make and Sell For Extra Money | Make Money. Mirakl's products are built to make these complex connections simple and scalable to drive a profitable and sustainable commerce business. Adopt the most. The online jewelry market is more successful than you might expect, considering the nature of buying online means customers can't inspect products before. Bookshelves, bookcases, and bookends are all selling well and usually have high profit margins. If you add this to your eCommerce or wholesale catalog, make. Clothing, Shoes & Jewelry will always make the list of best products to sell on Amazon for beginners and many other online marketplaces. Currently, Amazon. Boost Profitability with these Most Demanded Products · Start Online Clothing Business For Fashion Lovers · Start Online Cell Phones Selling Business For.

You can successfully sell a wide range of products, like notebooks, diaries, pens, gift wrapping, cards, tape, etc. The list goes on and on. Add quirky designs. Home decor and apparel are the two most lucrative categories for Etsy sellers to compete in. Offering customization and personalization options in your Etsy. Make More Sales · Make More Sales · Make More Sales · Product Idea # 1: Jewelry · Product Idea # 2: Digital Products · Product Idea # 3: Artwork · Product Idea # 4. While there are many profitable dropshipping niches for Facebook Marketplace, we must not forget about Seasonal Products. To clarify, seasonal products are. Friendship bracelets are some of the most popular home crafts to sell online. Moreover, they let you make money online with minimal upfront investment. For. Craft & Supplies is the top-selling category on Etsy with most sales. You can opt for craft essentials, miniatures, tools for jewelry, beads, and much more. The. Digital products to sell online · 1. Courses · 2. Ebooks · 3. Digital workbooks · 4. Guides · 5. Digital files · 6. Coaching · 7. Access to a membership site. Best trending products to sell online in the UAE in · 1. Electronics · 2. Fashion and beauty products · 3. Home appliances · 4. Food · 5. Baby products · 6. Car. The possibilities: Turn a personal hobby into a business by selling crafts online. There are many things to make and sell like custom art or handmade jewelry. Ultimately the goal of selling products online is to make a profit. So you need to look at the average selling price and make sure that you can source the. Dropshipping: this consists of selling other people's products and acting as an intermediary between the maker and the client through your website. The best. People buy a lot: clothes and fashion in general are the products that sell the most because people are not afraid of buying them online anymore. There are some. Sell things online at larger sites like Amazon for a quick sale. Seek local online selling sites like Nextdoor for sales that are fee-free but more. 5 Low Cost Ecommerce Products with High Profit Margins · 1. Fitness equipment · 2. Watches · 3. Jewelry · 4. Skincare products · 5. Sunglasses. Warby. In many instances, these are unique, one-of-a-kind or handmade products, making them some of the most popular items bought online. Niche products are often made. Best trending products to sell online in the UAE in · 1. Electronics · 2. Fashion and beauty products · 3. Home appliances · 4. Food · 5. Baby products · 6. Car. The last customizable product on our list is the Enhanced Matte Paper Poster with hanger. The matte paper poster was the most popular home & living product sold. If you're thinking about getting into the ecommerce game, you can't go wrong with selling digital products. From podcasts to ebooks, online courses to video. Musical instruments are great items to sell online, particularly those of high quality or with a well-known brand name. Instruments such as guitars, pianos.

Blockchain Payments Companies

Numerous banks and companies plan to get blockchain payment systems implemented in their business to conduct safe and quick cross-border payments. In this article we examine what crypto payment service providers do and how they can benefit from Crypto APIs. Best Blockchain Payment Systems At A Glance ; Circle · (11) ; Mastercard Blockchain · (10) ; BitFury · (10) ; Tezos · (5) ; Zerohub · (4). Tap crypto's potential with a pioneer in global payments · A leading payment network with 65+ crypto wallet partners · Developing native digital currency. Cash App. Blockchain • Fintech • Mobile • Payments • Software • Financial Services. San Francisco, CA, US. 3, Blockchain payments refer to the use of blockchain technology to facilitate the transfer of funds. Unlike traditional payment methods that rely. Top 20 Cross-Border Payment Companies using Blockchain · 1. Electroneum · 2. GCash · 3. Tassat · 4. BloomX · 5. Diem Association · 6. InstaReM · 7. Xapo · 8. CoinsPaid is an Estonia-licensed crypto payment provider that complies with KYB/AML regulations and has successfully passed multiple independent cybersecurity. Since in paytech and since in blockchain development, ScienceSoft helps businesses design and build robust blockchain-based payment solutions. Numerous banks and companies plan to get blockchain payment systems implemented in their business to conduct safe and quick cross-border payments. In this article we examine what crypto payment service providers do and how they can benefit from Crypto APIs. Best Blockchain Payment Systems At A Glance ; Circle · (11) ; Mastercard Blockchain · (10) ; BitFury · (10) ; Tezos · (5) ; Zerohub · (4). Tap crypto's potential with a pioneer in global payments · A leading payment network with 65+ crypto wallet partners · Developing native digital currency. Cash App. Blockchain • Fintech • Mobile • Payments • Software • Financial Services. San Francisco, CA, US. 3, Blockchain payments refer to the use of blockchain technology to facilitate the transfer of funds. Unlike traditional payment methods that rely. Top 20 Cross-Border Payment Companies using Blockchain · 1. Electroneum · 2. GCash · 3. Tassat · 4. BloomX · 5. Diem Association · 6. InstaReM · 7. Xapo · 8. CoinsPaid is an Estonia-licensed crypto payment provider that complies with KYB/AML regulations and has successfully passed multiple independent cybersecurity. Since in paytech and since in blockchain development, ScienceSoft helps businesses design and build robust blockchain-based payment solutions.

Blockchain payment systems have paved the way for faster and easier crypto payments and transactions. As businesses leverage blockchain-based payment systems. Increasingly, banks and fintechs are working side-by-side. For example, Ripple, a blockchain payment company, has partnered with over financial institutions. Roughly 2, US businesses accept bitcoin, according to one estimate from late , and that doesn't include bitcoin ATMs 1. An increasing number of companies. Cross-border payments Global dollar access Crypto capital markets Case studies Business Activity by the New York State Department of Financial Services. Blockchain Payments Systems reviews, comparisons, alternatives and pricing. The best Blockchain Payments solutions for small business to enterprises. It enables you to accept payments and make payouts via over methods and different currencies, including cryptocurrencies, via more than providers. If. Payment Service Providers. Enable your merchants to accept digital currencies and tap into M+ cryptocurrency users. All without touching digital currencies. For trade finance applications, a key capability of blockchain technologies is smart contracts. These are small, self-executing programs stored on the. Our client roster includes some of the largest fintech and technology firms as well as crypto-native firms engaging in crypto/Web3 exchange, payments, trading. Roughly 2, US businesses accept bitcoin, according to one estimate from late , and that doesn't include bitcoin ATMs 1. An increasing number of companies. Stripe gives crypto businesses access to today's global financial infrastructure. Whether you're an established crypto business or simply exploring new. Visit blue-host.ru to see hundreds of companies and stores that accept Bitcoin and other top crypto. Find all of the best places where you can spend crypto. Paystand helps you leverage enterprise blockchain to streamline payments, reduce costs, and increase security. Learn how to transform your business today. Analyzing payments leaders' activity so far: Mastercard, PayPal, and Visa make moves in crypto and cross-border payments. The key thing to understand is that Bitcoin uses blockchain as a means to transparently record a ledger of payments or other transactions between parties. “CoinGate provides both a wide selection of cryptocurrencies and a seamless payment workflow that allows the user to complete transactions seamlessly. And all. Square helps sellers run and grow their businesses with its integrated ecosystem of commerce solutions, business software, and banking services. With Cash App. With OpenNode, businesses can choose automatic conversion to receive local currency, and always get instant (Lightning Network) or near instant (on-chain) final. BitPay is the best crypto app to pay with crypto and accept crypto payments. Create a wallet to buy, store, swap and spend securely. We are the first global bank to offer a blockchain-based platform for wholesale payments transactions, helping to re-architect the way that money, information.

What Is Considered High Apr For A Credit Card

A good APR for a credit card is around 17% or below. A credit card APR in this range is on par with the interest rates charged by credit cards for people with. Save more of your hard-earned money and apply for a Bank of America® credit card with a low intro APR on purchases. A good APR is anything under 22% – which is the average APR for credit cards in America. For an excellent APR, aim for 18% or less. This is considered an. APR gives you an estimate of how much your credit card borrowing will cost over a year – as a percentage of the money borrowed. The higher it is, the more. Most credit cards have high APRs. The average right now is around 23%, and even credit cards for people with good or excellent credit charge. September's rate remained flat compared to last month after it rose by 10 basis points compared to % seen at the beginning of summer. Credit card interest. Penalty APR. These rates are typically very high and may be charged when you miss a payment or otherwise violate the terms of your account. The penalty APR. The highest credit card interest rate in recent memory was % on a card offered by First Premier Bank in but that offer's not available anymore. If your score is lower, an APR of 25% could be considered good. Credit card companies typically offer better rates to people with higher credit scores. A good APR for a credit card is around 17% or below. A credit card APR in this range is on par with the interest rates charged by credit cards for people with. Save more of your hard-earned money and apply for a Bank of America® credit card with a low intro APR on purchases. A good APR is anything under 22% – which is the average APR for credit cards in America. For an excellent APR, aim for 18% or less. This is considered an. APR gives you an estimate of how much your credit card borrowing will cost over a year – as a percentage of the money borrowed. The higher it is, the more. Most credit cards have high APRs. The average right now is around 23%, and even credit cards for people with good or excellent credit charge. September's rate remained flat compared to last month after it rose by 10 basis points compared to % seen at the beginning of summer. Credit card interest. Penalty APR. These rates are typically very high and may be charged when you miss a payment or otherwise violate the terms of your account. The penalty APR. The highest credit card interest rate in recent memory was % on a card offered by First Premier Bank in but that offer's not available anymore. If your score is lower, an APR of 25% could be considered good. Credit card companies typically offer better rates to people with higher credit scores.

This is the range your assigned APR will fall within, and usually spans about 10%. Plenty of factors go into your actual credit card APR, including the type of. Stating the interest rate in this standardized way allows consumers to easily compare rates between different cards. By law, credit card issuers must give you a. Credit card interest is a way in which credit card issuers generate revenue. A card issuer is a bank or credit union that gives a consumer (the cardholder). Credit card balance ; Interest rate ; How do you plan to payoff? Pay a certain amount. pay per month. or use Interest + 1% of Balance, 2%, 3%, 4%, 5%. For someone with a good or very good credit score, an APR of 20% could be good, while a 12% APR may be good for someone with an excellent score. If your score. When choosing a credit card based on APR, opt for anything under 22% – which is the average APR for credit cards in America. For an excellent APR, aim for 18%. A low interest rate credit card has a rate of interest that is usually less than the typical interest rate of %. Using the VantageScore ® model, scores above may be considered good or excellent. Credit cards with high APRs. Rewards credit cards and store credit. An APR between 10% and 15% is considered good. Credit Card companies assess your Credit Score to determine your APR, hence, maintaining a high Credit Score. A credit card's APR (annual percentage rate) is the total cost of its interest rate (eg 20%) plus the fees every cardholder pays as standard, such as the. An APR is considered to be a good rate when it is at or below the national average, which currently sits at %, according to the Fed. The APR you receive often varies with the prime rate, which is the best interest rate issuers charge consumers, unless you open a credit card with a fixed APR. A credit card interest rate below 13 percent is considered low because it's less than what credit cards for people with excellent credit traditionally charge. Stating the interest rate in this standardized way allows consumers to easily compare rates between different cards. By law, credit card issuers must give you a. Meanwhile, the Chase Freedom® offers a variable APR ranging from % to %. Your interest rate will be somewhere in this range, but can also go up or. According to Bankrate senior industry analyst Ted Rossman, the line in the sand for retail cards has traditionally been a 30% APR. "In fact, % was an. Credit card APRs usually range from 15% to 20%, and can go much higher. It is at the lender's discretion and decision. Some cards may have APRs of 30% or higher. Having a high interest rate on your credit card means you'll end up paying more for things you buy, unless you pay your credit card bill off every month. It. The cash advance APR is the cost of borrowing cash from a credit card. This rate tends to be higher than the purchase APR. And keep in mind that there are other. Cash Advance APR: the amount of interest charged on any cash you withdraw from your credit card account. This APR is usually higher than your purchase APR. APR.

1 2 3 4 5 6 7